Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.

Explore tax-smart gift options

Learn about gifts that maximize the impact of your support while providing tax benefits for you!

Stocks and securities

Donating stock or mutual funds may help you avoid paying capital gains taxes.

Donor Advised Funds

Easily recommend grants to Florida Sheriffs Association for tax-efficient giving.

Cryptocurrency

Donate Bitcoin, Ethereum, and more to save on taxes and make a big impact.

Qualified Charitable Distributions

Use your IRA to make tax-free gifts that benefit you and our mission.

Real Estate

Donate real estate to make a lasting impact, unlocking the hidden potential of your property’s value.

Retained Life Estate

Secure your home’s future through a Retained Life Estate, ensuring support for us while residing in your property.

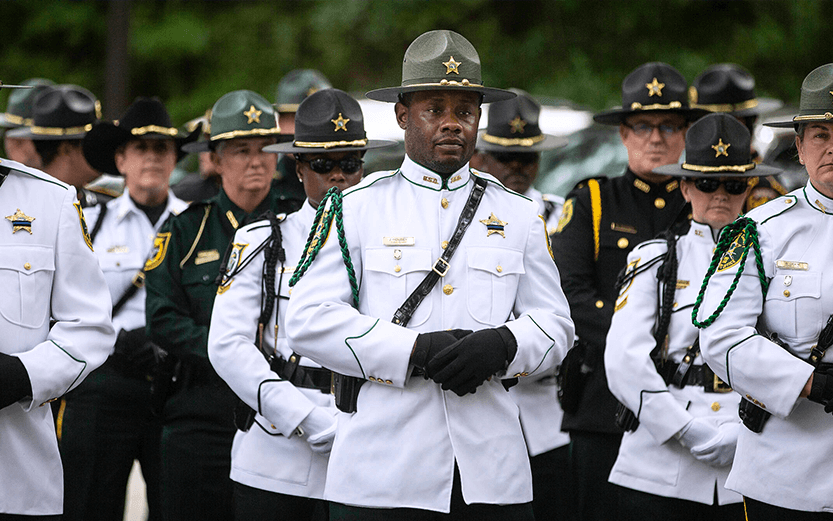

DONATE TODAY. IMPACT TOMORROW.

With your donation to our educational and cooperative programs, you help us provide training, technical expertise and assistance to sheriffs’ offices throughout the state. Your contribution also supports the youth in our state through the Florida Sheriffs Youth Ranches, the Teen Driver Challenge, and the Florida Sheriffs Explorers Association.

Your donation can be earmarked for any of these special programs created to meet specific needs in our state – or you can simply designate it to go wherever it’s needed the most.

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Mickey S. Moore

Title :Director, Membership & Donor Relations

Phone: 850-656-5803

Email: mmoore@flsheriffs.org

Already included us in your estate plan? Let us know

More ways to make an impact

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will (for free!).

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.